In the ever-evolving world of finance and personal credit management, technological advancements are reshaping the landscape. One such innovation that has captured the attention of consumers and industry experts alike is the emergence of AI credit repair software. This cutting-edge technology is poised to revolutionize the credit repair industry, offering a more efficient, accurate, and personalized approach to optimizing credit scores and financial health.

What is AI Credit Repair Software?

AI credit repair software is a sophisticated software solution that harnesses the power of artificial intelligence and machine learning algorithms to analyze credit reports, identify potential errors or inaccuracies, and streamline the credit repair process. By leveraging advanced data analysis techniques, these software solutions can quickly pinpoint issues that may be negatively impacting an individual’s credit score and provide tailored recommendations for resolving them.

How Does AI Credit Repair Software Work?

Data Collection and Analysis

The first step in the AI credit repair process is data collection and analysis. Users typically provide their credit reports, which the software meticulously scans and processes using advanced algorithms. These algorithms are trained to recognize patterns, inconsistencies, and potential errors that may be present in the credit report data.

Error Identification

Once the data has been analyzed, the AI credit repair software uses its trained models to identify potential errors or inaccuracies. These can range from simple mistakes, such as incorrect personal information or duplicate entries, to more complex issues like incorrect payment histories or wrongfully reported delinquencies.

Dispute Automation

After identifying potential errors, the AI credit repair software streamlines the dispute process by automating the generation of dispute letters and corresponding documentation. These dispute letters are tailored to the specific issues identified in the credit report, providing creditors and credit bureaus with detailed information and supporting evidence to facilitate the resolution process.

Benefits of Using AI Credit Repair Software

Time and Cost Efficiency

One of the most significant advantages of AI credit repair software is its ability to save time and reduce costs associated with the traditional credit repair process. By automating many of the time-consuming tasks, such as data analysis and dispute letter generation, these software solutions can significantly accelerate the credit repair journey. Additionally, by identifying errors more accurately and efficiently, consumers can potentially resolve credit issues faster, reducing the overall time and effort required.

Increased Accuracy

AI algorithms are designed to analyze data with a level of precision and consistency that is often difficult for humans to match. By leveraging machine learning models trained on vast amounts of credit data, AI credit repair software can identify patterns and anomalies that may be easily overlooked by manual review. This increased accuracy translates into a higher likelihood of successfully resolving credit issues and improving credit scores.

Personalized Solutions

Every individual’s credit situation is unique, with varying factors contributing to their credit score and financial health. AI credit repair software accounts for these individual differences by providing personalized solutions tailored to each user’s specific credit profile. By analyzing the unique patterns and issues present in a user’s credit report, the software can recommend targeted strategies and action plans to address their specific credit challenges effectively.

“The integration of AI into credit repair software has the potential to revolutionize the industry by providing consumers with a more efficient, accurate, and personalized approach to improving their credit scores.” – Credit Repair Cloud Blog

Continuous Monitoring and Updates

Unlike traditional credit repair methods that often require manual monitoring and updating, AI credit repair software can continuously monitor credit reports for changes and updates. As new information becomes available or credit bureaus respond to disputes, the software can automatically analyze the data and provide real-time updates and recommendations. This ongoing monitoring ensures that users stay informed and can take prompt action to maintain their credit health.

Key Features of AI Credit Repair Software

Credit Report Analysis

At the core of AI credit repair software is its ability to perform in-depth analysis of credit reports. These solutions leverage advanced algorithms and machine learning models to scrutinize every aspect of a credit report, including personal information, credit accounts, payment histories, and public records. By identifying potential errors, inconsistencies, or inaccuracies, the software can provide a comprehensive roadmap for credit repair.

Dispute Letter Generation

One of the most time-consuming and tedious aspects of the credit repair process is drafting dispute letters to creditors and credit bureaus. AI credit repair software automates this process by generating customized dispute letters based on the identified errors in a user’s credit report. These letters are designed to comply with relevant regulations and include all necessary supporting documentation, increasing the likelihood of successful disputes.

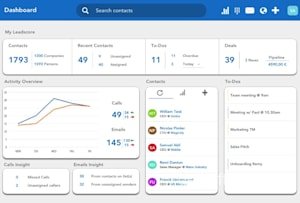

Creditor Communication

Effective communication with creditors and credit bureaus is crucial in the credit repair process. AI credit repair software often includes features that facilitate this communication, such as automated follow-ups, status updates, and secure document sharing. By streamlining these interactions, users can stay informed and engaged throughout the credit repair journey.

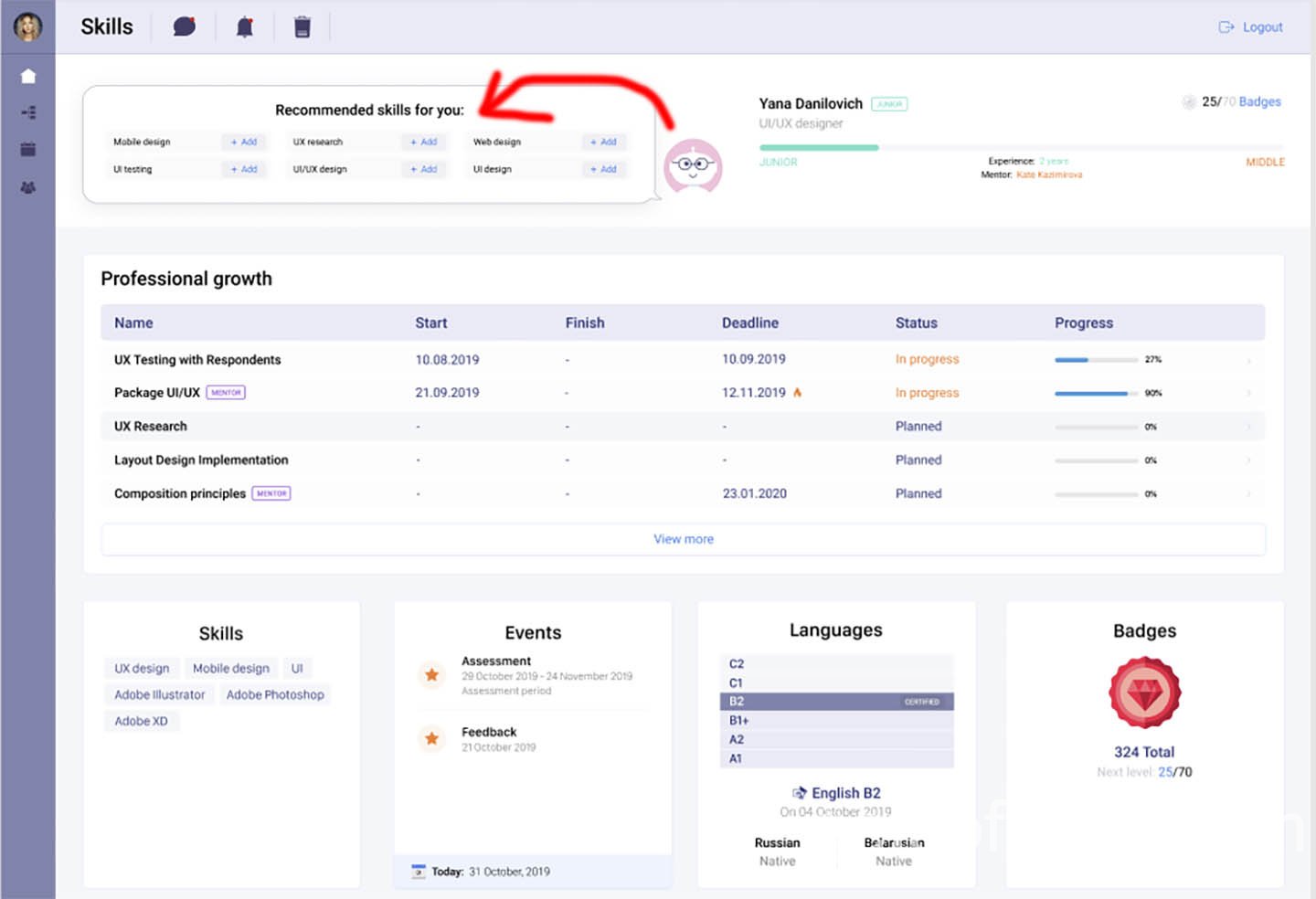

Progress Tracking

Monitoring progress is essential for gauging the effectiveness of credit repair efforts. AI credit repair software typically includes robust tracking and reporting features that allow users to monitor their credit score changes, track the status of disputes, and visualize their overall progress over time. This transparency empowers users to make informed decisions and adjust their strategies as needed.

Credit Score Simulations

One unique feature offered by some AI credit repair software solutions is the ability to run simulations and forecasts. By analyzing a user’s credit profile and potential actions, the software can provide insights into how different scenarios might impact their credit score. This valuable information can help users prioritize their efforts and make informed decisions about their credit repair strategies.

Potential Drawbacks and Limitations

Data Privacy Concerns

While AI credit repair software offers numerous benefits, it is important to address potential drawbacks and limitations. One key concern revolves around data privacy and security. As these software solutions require access to sensitive personal and financial information, there is a risk of data breaches or misuse of personal data. Consumers should carefully evaluate the data privacy policies and security measures implemented by software providers before entrusting them with their sensitive information.

Dependence on Algorithms

Another potential limitation of AI credit repair software is its dependence on algorithms and machine learning models. While these models are designed to be highly accurate, they are ultimately based on the data they are trained on and the algorithms used. There is a possibility that certain edge cases or unique situations may not be accurately identified or addressed by the software, requiring human intervention or oversight.

Limited Human Oversight

While the automation and efficiency provided by AI credit repair software are advantageous, there is a risk of limited human oversight in the process. Certain complex credit issues or unique circumstances may require a more nuanced approach and human expertise. Users should be aware of this potential limitation and be prepared to seek additional support or guidance when necessary.

Regulatory Challenges

The credit repair industry is subject to various regulations and consumer protection laws, which may pose challenges for AI credit repair software providers. As this technology continues to evolve, there may be uncertainties or gaps in regulatory frameworks governing the use of AI in credit repair. Software providers will need to stay up-to-date with evolving regulations and ensure compliance to avoid potential legal and ethical issues.

While these drawbacks and limitations should be considered, many industry experts believe that the benefits of AI credit repair software outweigh the potential risks, particularly as the technology matures and best practices are established.

Top AI Credit Repair Software Providers

Provider 1: Credit Repair Cloud

Overview

Credit Repair Cloud is a leading provider of AI-powered credit repair software solutions. Their platform leverages advanced machine learning algorithms and data analysis techniques to help consumers identify and resolve credit report errors efficiently.

Key Features

- Automated credit report analysis and error identification

- Customized dispute letter generation

- Secure creditor communication and document sharing

- Credit score tracking and progress monitoring

- Credit score simulations and forecasting

Pricing and Plans

Credit Repair Cloud offers flexible pricing plans to cater to different user needs, including:

Basic Plan: $49/month

Standard Plan: $99/month

Premium Plan: $149/month

Provider 2: Upsolve

Overview

Upsolve is a non-profit organization that offers a suite of AI-powered credit repair tools and resources. Their software is designed to provide accessible and affordable credit repair solutions to individuals facing financial challenges.

Key Features

- AI-driven credit report analysis and error detection

- Automated dispute letter generation and tracking

- Educational resources and credit counseling

- Credit score monitoring and progress tracking

Pricing and Plans

Upsolve offers its AI credit repair software at no cost to users, making it an attractive option for those with limited financial resources.

Provider 3: Creditsafe

Overview

Creditsafe is a global provider of business intelligence and credit risk solutions. In addition to their core offerings, they have developed an AI-powered credit repair software designed for individuals and small businesses.

Key Features

- AI-driven credit report analysis and error detection

- Customized dispute letter generation with legal compliance

- Secure creditor communication and document management

- Credit score monitoring and alerts

- Integration with Creditsafe’s business intelligence platform

Pricing and Plans

Creditsafe’s AI credit repair software is available through a subscription model, with pricing based on the specific features and service level required.

These are just a few examples of the many AI credit repair software providers currently available in the market. It’s important to carefully evaluate each provider’s offerings, pricing, and user reviews to determine the best fit for your specific needs and budget.

Choosing the Right AI Credit Repair Software

With the increasing number of AI credit repair software solutions available in the market, selecting the right one for your needs can be a daunting task. It’s essential to carefully evaluate your specific requirements, budget, and priorities to ensure you choose a solution that aligns with your goals and provides the best value for your investment.

Factors to Consider

Pricing and Affordability

One of the primary considerations when choosing an AI credit repair software is pricing and affordability. While some providers offer free or low-cost options, others may have more comprehensive (and expensive) plans. It’s crucial to evaluate the pricing structure and included features to ensure you get the best value for your money. Additionally, consider any potential long-term costs or recurring fees associated with the software.

Features and Functionality

Different AI credit repair software solutions offer varying levels of features and functionality. Some may focus solely on credit report analysis and dispute letter generation, while others may provide additional tools like credit score simulations, progress tracking, and creditor communication capabilities. Assess your specific needs and priorities to ensure the software you choose has the features you require.

User Experience and Support

The user experience and level of support provided by the software provider can significantly impact your overall satisfaction with the product. Look for solutions with intuitive interfaces, clear documentation, and responsive customer support channels. Additionally, read user reviews and testimonials to gauge the experiences of others who have used the software.

Evaluating Your Specific Needs

Before selecting an AI credit repair software, it’s essential to assess your specific needs and goals. Consider factors such as the complexity of your credit situation, the number of accounts or errors you need to address, and your desired level of involvement in the process. Some individuals may prefer a more hands-off approach, while others may want greater control and visibility into the credit repair process.

Once you’ve identified your needs, research and compare different software solutions to find the one that best aligns with your requirements. Don’t hesitate to reach out to providers for clarification or additional information to ensure you make an informed decision.

The Future of AI in Credit Repair

As AI technology continues to evolve and become more sophisticated, its applications in the credit repair industry are expected to grow and expand. Here are some potential developments and trends that may shape the future of AI in credit repair:

Advancements in Machine Learning

One of the primary drivers of AI’s progress is the continued advancement of machine learning algorithms and techniques. As these algorithms become more sophisticated and capable of handling larger and more complex datasets, AI credit repair software will become even more accurate and efficient in identifying and resolving credit issues.

Integration with Other Financial Tools

In the future, AI credit repair software may become integrated with other financial tools and platforms, creating a comprehensive ecosystem for managing personal finances. For example, AI-powered budgeting apps, investment advisors, and financial planning tools could seamlessly integrate with credit repair software, providing users with a holistic view of their financial health and tailored recommendations.

Regulatory Developments

As the use of AI in credit repair becomes more widespread, regulatory bodies and consumer protection agencies may develop new guidelines and frameworks to ensure the responsible and ethical use of this technology. These regulations could address issues such as data privacy, algorithmic bias, and transparency, ultimately benefiting consumers and promoting trust in AI credit repair solutions.

“The future of AI in credit repair looks promising, with the potential to create a more efficient, accurate, and personalized experience for consumers. However, it’s crucial that the industry embraces responsible and ethical practices to protect consumer rights and maintain trust.” – CFPB Blog

Conclusion

Embracing the AI Revolution

The rise of AI credit repair software represents a significant paradigm shift in the credit repair industry. By leveraging advanced algorithms and machine learning techniques, these software solutions offer a more efficient, accurate, and personalized approach to optimizing credit scores and financial health.

As consumers become increasingly aware of the potential benefits of AI credit repair software, adoption rates are likely to surge. However, it’s crucial for both consumers and software providers to remain vigilant about data privacy, ethical practices, and regulatory compliance to ensure the responsible and sustainable growth of this technology.

Final Thoughts and Recommendations

If you’re considering utilizing AI credit repair software, take the time to thoroughly research and evaluate different providers. Consider your specific needs, budget, and priorities, and don’t hesitate to seek guidance from financial experts or consumer advocacy groups if needed.

Remember, while AI credit repair software can be a powerful tool, it should be viewed as a complement to, rather than a replacement for, responsible financial habits and prudent credit management practices. By combining the power of AI with a solid understanding of credit fundamentals, you can maximize your chances of achieving and maintaining a healthy credit profile.

Embrace the AI revolution in credit repair, but do so with caution and a commitment to ethical and responsible practices. The future of personal finance is rapidly evolving, and those who adapt to these technological advancements may find themselves better equipped to navigate the complexities of credit and financial management.

Frequently Asked Questions

Is AI credit repair software legal and compliant?

Yes, reputable AI credit repair software providers design their solutions to comply with relevant consumer protection laws and regulations, such as the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA). However, it’s essential to carefully review the policies and practices of specific providers to ensure they operate within legal and ethical boundaries.

Can AI credit repair software guarantee a specific credit score increase?

No, responsible AI credit repair software providers should not make guarantees or promises of specific credit score increases. Credit scores are influenced by a variety of factors, and the success of credit repair efforts depends on the individual’s unique credit situation and the accuracy of the information in their credit reports.

How long does the AI credit repair process typically take?

The duration of the credit repair process can vary significantly based on the complexity of the issues being addressed and the responsiveness of creditors and credit bureaus. Some simple errors or disputes may be resolved within a few weeks or months, while more complex situations could take several months or longer.

Can I use AI credit repair software if I have a bankruptcy or other major derogatory items on my credit report?

Yes, AI credit repair software can be beneficial even for individuals with more severe credit issues, such as bankruptcies or foreclosures. While these major derogatory items cannot be removed from credit reports until they naturally age off, the software can still help identify and resolve other potential errors or inaccuracies that may be negatively impacting credit scores.

Do I need to have technical expertise to use AI credit repair software?

No, most AI credit repair software solutions are designed to be user-friendly and accessible to individuals with varying levels of technical expertise. The software typically provides intuitive interfaces and clear instructions, making it easy for anyone to navigate and utilize the features effectively.

Remember, if you have any additional questions or concerns, don’t hesitate to reach out to the GetSoftNow team. We’re here to help you navigate the world of software and technology, including the exciting realm of AI credit repair solutions.

Leave a Reply